When it comes to precision, productivity, and reliability in modern manufacturing, choosing the right CNC machine brand is a critical decision. From high-speed 5-axis machining to smart automation, top global manufacturers continue to shape the future of machining. In this guide, I will walk you through the world’s top 20 CNC machine brands, giving you a clear picture of who leads the industry and why. Whether you’re setting up a new factory or upgrading your production line, this list will answer the core question: which CNC brands are the most trusted worldwide?

Overview Table & Global Ranking

Before diving into the technical and strategic analysis of each brand, here’s a quick overview of the leading cnc machining manufacturer across the globe. This table shows where each company is based, what types of machines they offer, and their main application industries.

| Rank | Manufacturer Name | Country / Region | Main Application Industries |

| 1 | DMG MORI | Germany / Japan | Aerospace, Automotive, Medical, Mold Making |

| 2 | MAZAK | Japan | General Machinery, Automotive, Energy, Medical |

| 3 | HAAS Automation | USA | Education, Automotive, General Manufacturing, Tooling |

| 4 | TRUMPF Group | Germany | Sheet Metal, Aerospace, Electronics, Construction |

| 5 | FANUC | Japan | Automation, Robotics, Electronics, Automotive |

| 6 | Okuma | Japan | Aerospace, Heavy Industry, General Machinery, Energy |

| 7 | Makino | Japan | Precision Molds, Aerospace, Medical |

| 8 | Doosan Machine Tools | South Korea | Heavy Industry, Energy Equipment, General Manufacturing |

| 9 | CHIRON Group | Germany | Automotive, Medical Technology, Precision Engineering |

| 10 | GROB | Germany | Automotive, EV Components, General Manufacturing |

| 11 | EMAG | Germany | Drivetrains, Braking Systems, Energy, Industrial Machinery |

| 12 | Hurco | USA | Education, Toolmaking, Part Prototyping |

| 13 | Hardinge Inc. | USA | Medical, Aerospace, Precision Components |

| 14 | JTEKT Toyoda Americas | USA / Japan | Automotive, Heavy Equipment, Bearing Production |

| 15 | Studer | Switzerland | Precision Grinding, Medical, Instrumentation |

| 16 | Yamazaki Mazak UK Ltd | UK / Japan | Metal Cutting, Automation, General Industrial |

| 17 | Siemens | Germany | Industrial Automation, Robotics, Energy, Manufacturing IT |

| 18 | Tornos Group | Switzerland | Medical Devices, Connectors, Watchmaking |

| 19 | SMTCL (Shenyang Machine Tool) | China | General Machinery, Automotive Parts, Heavy Industry |

| 20 | WIA Machine America Corp | South Korea | General Manufacturing, Automotive, Energy Equipment |

Leading Brands

These 20 manufacturers have earned global recognition through decades of technological innovation, consistent performance, and trusted customer service. In the sections below, I’ll introduce each brand from a practical, hands-on perspective—highlighting how their machines perform on the shop floor and what sets them apart in real-world manufacturing environments.

1. DMG MORI (Germany/Japan)

Company Profile: A fusion of German precision and Japanese efficiency, DMG MORI is one of the largest and most versatile CNC machine suppliers globally.

Product Types: Lathes, 5-axis machines, vertical and horizontal machining centers, mill-turns.

Tech Features: Strong focus on automation, Industry 4.0 integration, CELOS control system.

Certifications & Applications: ISO 9001, used heavily in aerospace, energy, and high-precision medical sectors.

Market Strength: Service networks across 43 countries; extensive local support and digital services.

2. MAZAK (Japan)

Company Profile: Founded in 1919, MAZAK is a pioneer in Multi-Tasking machines.

Product Types: CNC lathes, 5-axis machines, hybrid Multi-Tasking, automation lines.

Tech Features: SMOOTH Technology, AI-powered tool monitoring, high-speed control.

Certifications & Applications: Aerospace-certified, widely used in energy and defense industries.

Market Strength: Strong U.S. and Europe support networks, local production in the U.S.

3. HAAS Automation (USA)

Company Profile: America’s largest CNC builder, known for value and availability.

Product Types: Vertical/Horizontal machining centers, CNC lathes, rotary tables.

Tech Features: Simple controls, affordable automation, built-in diagnostics.

Certifications & Applications: ISO certified; ideal for automotive, job shops, and education.

Market Strength: Short lead times, vast distributor network, especially in North America.

4. TRUMPF Group (Germany)

Company Profile: Expert in laser-based CNC systems and sheet metal processing.

Product Types: Laser cutting machines, punching, press brakes.

Tech Features: Fiber lasers, power electronics, smart control integration.

Certifications & Applications: Dominates sheet metal and medical device industries.

Market Strength: Global leadership in laser tech; strong in EU and U.S. markets.

5. FANUC (Japan)

Company Profile: A global leader in CNC controls and factory automation.

Product Types: CNC systems, robotic arms, machining modules.

Tech Features: Ultra-stable servo control, compact design, high-speed automation.

Certifications & Applications: Automotive, electronics, and large-scale automation lines.

Market Strength: Installed in millions of machines; unrivaled control system compatibility.

6. Okuma (Japan)

Company Profile: Known for self-developed CNC controls and ultra-stable machines.

Product Types: CNC lathes, 5-axis machines, double-column machining centers.

Tech Features: Thermo-Friendly Concept, OSP control system.

Certifications & Applications: Used in oil & gas, aerospace, and railway sectors.

Market Strength: Excellent reliability; strong presence in Asia and North America.

7. Makino (Japan)

Company Profile: Specialist in high-speed precision machining.

Product Types: 5-axis centers, EDM machines, horizontal machining centers.

Tech Features: Proprietary software, low thermal distortion design.

Certifications & Applications: Aerospace and mold & die industries.

Market Strength: High-end product positioning; extensive R&D investment.

8. Doosan Machine Tools (Korea)

Company Profile: Part of South Korea’s industrial backbone, widely trusted.

Product Types: Turning centers, multitasking machines, horizontal mills.

Tech Features: Easy control interfaces, robust castings, Fanuc controls.

Certifications & Applications: Automotive and heavy industry approved.

Market Strength: Strong APAC presence; competitive pricing.

9. CHIRON Group (Germany)

Company Profile: Focuses on fast, compact machining centers.

Product Types: Vertical machining centers, mill-turns.

Tech Features: Dynamic 5-axis machining, modularity.

Certifications & Applications: Automotive, tooling, electronics.

Market Strength: Dominant in high-volume part machining.

10. GROB (Germany)

Company Profile: Nearly a century of engineering excellence.

Product Types: 4/5-axis machining centers, mill-turns, EV manufacturing systems.

Tech Features: Linear motor drives, e-mobility integration.

Certifications & Applications: Aerospace, EV, automation.

Market Strength: Strong in Europe and emerging in EV manufacturing globally.

11. EMAG (Germany)

Company Profile: EMAG specializes in precision manufacturing solutions with a focus on turning and grinding technologies.

Product Types: Vertical turning machines, grinding machines, machining centers, gear cutting machines.

Tech Features: Vertical pick-up turning, ECM/PECM (electro-chemical machining), laser welding integration.

Certifications & Applications: Popular in transmission, powertrain, and aerospace component production.

Market Strength: Strong presence in Europe and Asia; valued for process integration capabilities.

12. Hurco (USA)

Company Profile: A U.S.-based innovator that blends advanced CNC tech with operator-friendly software.

Product Types: Vertical machining centers, CNC lathes, 5-axis mills.

Tech Features: MAX5 control, conversational programming, WinMax software.

Certifications & Applications: Ideal for prototyping, general machining, and job shops.

Market Strength: Best for small to mid-size businesses; widespread service in the U.S. and Europe.

13. Hardinge Inc. (USA)

Company Profile: Founded in 1890, Hardinge is a historical precision machining brand from the U.S.

Product Types: Precision lathes, grinding machines, machining centers.

Tech Features: High-precision spindle technology, multiaxis grinding.

Certifications & Applications: Aerospace, toolmaking, and semiconductor industries.

Market Strength: Strong North American presence; recognized for unmatched precision.

14. JTEKT Toyoda Americas (USA)

Company Profile: The U.S. arm of Japanese giant JTEKT, offering robust CNC solutions.

Product Types: Horizontal/vertical machining centers, grinding machines, bridge mills.

Tech Features: Patented cooling systems, boxway design, reliability in hard metals.

Certifications & Applications: Automotive transmission, heavy equipment.

Market Strength: Major supplier to North American automotive industry.

15. Studer (Switzerland)

Company Profile: A Swiss legend in precision cylindrical grinding.

Product Types: CNC universal, external, and internal grinding machines.

Tech Features: Granitan machine beds, adaptive control systems.

Certifications & Applications: Precision optics, surgical instruments, and micromachining.

Market Strength: Premium segment; exceptional surface finish capabilities.

16. Yamazaki Mazak UK Ltd (UK)

Company Profile: European branch of Mazak, combining global tech with local support.

Product Types: CNC lathes, vertical and horizontal centers, Multi-Tasking machines.

Tech Features: SmoothX CNC controls, UK-based tech training centers.

Certifications & Applications: Aerospace, defense, medical device production in Europe.

Market Strength: Strong UK and EU presence; extensive training and service infrastructure.

17. Siemens (Germany)

Company Profile: A global automation leader that also manufactures CNC systems.

Product Types: SINUMERIK CNC controllers, machining modules, digital twin software.

Tech Features: Industry 4.0 integration, virtual commissioning, AI-powered diagnostics.

Certifications & Applications: Heavy in smart manufacturing, electronics, automotive.

Market Strength: Backbone of many machine builders; controls used globally.

18. Tornos Group (Switzerland)

Company Profile: Precision-focused Swiss manufacturer known for multi-spindle lathes.

Product Types: Swiss-type lathes, bar feeders, precision turning solutions.

Tech Features: High-speed spindles, synchronized guide bushings.

Certifications & Applications: Medical, watchmaking, and micro-mechanical parts.

Market Strength: Dominant in micro-machining sectors across Europe and Asia.

19. SMTCL (China)

Company Profile: One of China’s largest and oldest CNC machine tool builders.

Product Types: Horizontal/vertical machining centers, CNC turning machines.

Tech Features: Cost-effective design, Fanuc-compatible controls.

Certifications & Applications: General manufacturing, railways, heavy industry.

Market Strength: Broadest market in China; government-supported growth.

20. WIA Machine America Corp (Korea)

Company Profile: Subsidiary of Hyundai, delivering CNC systems for automotive and heavy machinery.

Product Types: CNC lathes, machining centers, multi-tasking machines.

Tech Features: Smart control systems, strong integration with automation lines.

Certifications & Applications: Automotive, defense, heavy equipment.

Market Strength: Key supplier for Hyundai-Kia group; global growth in progress.

How To Choose The Right CNC Machine Brand

When choosing a CNC machine brand, focus on more than just cost. Assess your production needs, including part complexity and tolerances. Compare technologies like thermal control and automation. Evaluate after-sales service and local support. Balance cost with long-term ROI, and review brand reputation through case studies and real-world applications.

Define Production Needs

When I evaluate CNC machine brands, the first step is always to define my exact production requirements. This includes multiple technical factors that directly impact machine selection.

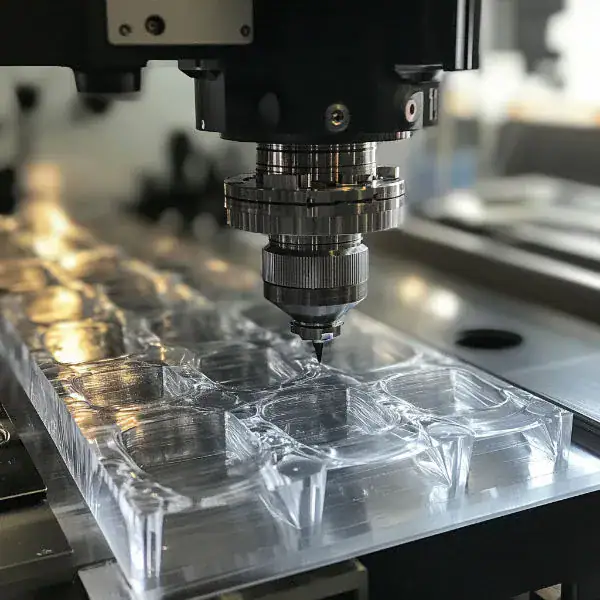

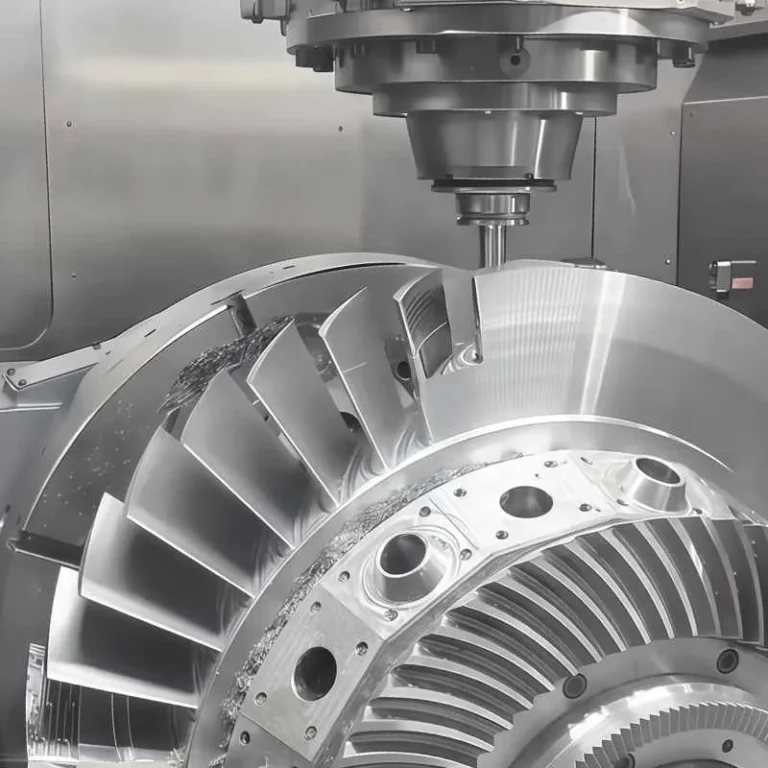

For example, if I’m working on highly intricate parts—like turbine blades or orthopedic implants—then a 5-axis machine with simultaneous motion becomes essential. In contrast, for simpler components like flanges or brackets, a 3-axis vertical machining center may suffice.

Part volume also matters. For prototyping or short runs, I look for flexibility and fast setup features. But when managing high-volume production—say, 10,000+ parts/month—I prioritize machines with fast tool changers, pallet changers, and automation compatibility.

Material type further refines my selection. If I’m machining hardened steel or titanium alloys, I need machines with high spindle torque and rigid construction. For aluminum or plastic, I prioritize high-speed spindles and thermal stability to avoid dimensional drift.

Tolerance is the most critical benchmark. In aerospace or medical applications, I often deal with ±0.005mm or tighter. Not all machines can hold that across multiple axes or over long cycles, so I review each brand’s real-world accuracy data and thermal compensation systems.

In summary, I don’t choose machines based on brand alone—I start with my parts, my tolerances, my materials, and my volume. The machine must fit the job, not the other way around.

Compare Core Technologies

When selecting a CNC machine brand, I go beyond the brochure and take a deep dive into the core technologies that define each manufacturer’s value. This step is crucial because even machines with similar specs on paper can perform very differently in practice.

Thermal control is one of the first things I look at. In high-precision jobs, even a temperature drift of 1°C can result in dimensional changes of several microns. That’s unacceptable when I’m targeting ±0.005mm tolerance. Brands like Okuma and Makino, for instance, offer advanced thermal compensation systems and symmetrical machine designs to minimize heat-induced distortion. These technologies help maintain consistent accuracy, even during long production cycles.

Automation is another major differentiator. If I’m running lights-out operations or high-mix, low-volume production, I need machines with seamless integration to robotic arms, automatic pallet changers, and tool life management systems. Companies like DMG MORI and Mazak excel here, offering factory-wide control systems like CELOS and SMOOTH Technology that centralize machine management, diagnostics, and workflow optimization.

Real-time monitoring is something I always consider in modern facilities. With IoT-based systems, I can track spindle load, tool wear, vibration, and temperature in real time. FANUC and Siemens offer robust platforms that let me predict failures, schedule preventive maintenance, and improve machine utilization—all backed by data, not guesswork.

In short, comparing core technologies isn’t just a checkbox exercise. I analyze how each brand approaches heat, automation, and data. These differences directly affect my output quality, machine uptime, and long-term ROI.

Evaluate After-Sales and Support

When investing in CNC machines, I never evaluate the equipment in isolation—I always assess the after-sales support structure with equal importance. No matter how advanced a machine is, its real-world performance hinges on timely service, parts availability, and technical assistance. A 30-minute production stop can cost thousands, especially in high-throughput environments. That’s why I prioritize brands with proven, responsive service networks.

First, I look into local presence. A manufacturer with a regional tech center or service base can often dispatch engineers within 24 hours. For example, HAAS Automation’s U.S.-based infrastructure ensures spare parts delivery in under 48 hours for most locations in North America. In contrast, machines from lesser-known brands without local support might sit idle for days—even weeks—waiting for parts or troubleshooting assistance.

Second, response time and expertise matter. Some manufacturers offer 24/7 technical hotlines, remote diagnostics, and even on-machine support tools. I’ve seen MAZAK’s SMOOTH platform provide step-by-step recovery guidance right on the control screen, reducing the need for on-site visits. Similarly, FANUC’s global support structure includes over 260 service centers worldwide, offering immediate access to firmware updates and part replacements.

I also value training and maintenance programs. Brands like Makino and Okuma often provide on-site training for operators and maintenance teams, helping reduce human error and downtime. Their preventive maintenance schedules and diagnostics software proactively alert me to mechanical wear or temperature drifts—helping me fix small issues before they escalate.

Finally, I consider the cost and clarity of extended warranty and support contracts. Transparent service plans that include routine inspections, software updates, and spare part kits give me better control over operating budgets.

Balance Cost, Lead Time, ROI

When selecting a CNC machine brand, I always weigh not just the upfront purchase price, but the total cost of ownership and how quickly the investment will pay off. It’s easy to be drawn to low-cost machines, but over the years, I’ve learned that high-end equipment often delivers a better return through productivity, reliability, and reduced operational waste.

For example, a premium 5-axis machining center from DMG MORI or Makino may cost 30–40% more initially than a mid-range competitor. However, its uptime often exceeds 98%, thanks to robust build quality and predictive maintenance features. That means fewer interruptions, longer tool life, and minimal unexpected downtime—all of which directly impact my bottom line.

Lead time is also a critical factor. If I’m running short lead-time production or prototyping, a brand with in-stock machines or local assembly—like HAAS or Mazak’s U.S. facilities—can deliver in 2–4 weeks, compared to 3–5 months from smaller or overseas suppliers. Fast delivery means faster revenue generation and less waiting for production readiness.

Then there’s material and scrap efficiency. Machines with better rigidity, thermal stability, and advanced probing (such as Okuma’s Thermo-Friendly Concept or FANUC’s smart tool compensation) consistently hit tolerances without requiring multiple passes or rework. In my shop, reducing scrap by even 2% over a year can save tens of thousands in wasted materials—especially when machining expensive alloys like titanium or PEEK.

From an ROI standpoint, I calculate the payback period by comparing production capacity gains, scrap rate reductions, energy consumption, and labor hours saved due to automation. In one case, upgrading to a higher-tier vertical machining center reduced cycle time by 25%, leading to full payback in just 14 months.

In short, balancing cost, lead time, and ROI is a strategic decision. I always look beyond the price tag to assess how the machine will perform over 5–10 years—because in precision manufacturing, what seems expensive today can be the most cost-effective decision tomorrow.

Consider Reputation

When I evaluate a CNC machine brand, reputation isn’t just a marketing buzzword—it’s a measurable indicator of long-term performance, stability, and user satisfaction. A brand’s reputation is built over years of real-world results, and I rely heavily on case studies, peer reviews, and reference factories to validate a manufacturer’s claims.

For example, when I consider a new 5-axis system, I look for published case studies showing consistent tolerances within ±0.003 mm over extended production runs. If a brand like Makino or GROB has documented success in aerospace or mold & die applications, that gives me confidence their equipment can handle thermal expansion, complex geometries, and continuous use without degradation.

I also connect with reference users in similar industries. A conversation with a factory running 24/7 in medical device manufacturing—where validation and consistency are mission-critical—tells me far more than a product brochure. If they’re using Okuma or DMG MORI with minimal downtime and strong support, it reinforces my trust in the brand.

Beyond performance, I examine the brand’s presence at global trade shows, participation in technical forums, and ISO or AS certifications. These factors signal a commitment to engineering excellence and compliance with international standards. A company like TRUMPF or Siemens, for instance, doesn’t just build machines—they invest heavily in R&D, smart manufacturing, and ecosystem partnerships.

Reputation is also reflected in how often a brand is specified in OEM manufacturing lines, especially in sectors like automotive, defense, or semiconductors. If major players consistently choose a specific brand, it usually indicates robust engineering, reliable output, and global service scalability.

End Word

Choosing the right CNC machine brand is not a one-size-fits-all decision—it’s a strategic move that impacts your productivity, cost-efficiency, and long-term competitiveness. From evaluating your specific production needs and comparing core technologies, to analyzing after-sales support, ROI, and brand reputation, each factor plays a crucial role in minimizing risk and maximizing performance. The top 20 cnc machine manufacturers in the world—featured in this guide—each offer distinct strengths across various industries, tolerances, and automation levels. By aligning your business goals with the right brand capabilities, you’re not just buying a machine—you’re investing in scalable, precision-driven success.