The CNC machining industry underpins modern manufacturing, turning digital designs into precise parts with speed and scale. This article covers what CNC machining is, the equipment and processes, digitalization, new materials, key applications, market trends, challenges, and how manufacturers can stay competitive. In this article, I’ll provide you with a clear understanding of the CNC industry today and where it’s headed.

What Is CNC Machining Industry

CNC machining is more than automated cutting—it is the bridge that transforms digital designs into real-world precision parts. From CAD models to G-code, machines operate with open- or closed-loop control, achieving micron-level accuracy and scaling from single prototypes to 24/7 lights-out production. By 2026, the CNC machine tool market is projected to exceed $129 billion, fueled by demand in EVs, aerospace, and medical devices.

What Is CNC Machining

When I explain CNC machining to clients, I often describe it as digital manufacturing in its purest form. A 3D CAD model is transformed into machine-readable code (commonly G-code), which guides the cutting tools to remove material with micron-level precision. This process is widely recognized as subtractive manufacturing, where the final part is created by systematically removing material from a solid block of metal, plastic, or composite.

CNC (Computer Numerical Control) machining integrates software, hardware, and advanced tooling. It is capable of achieving dimensional tolerances as tight as ±0.002 mm for high-precision components, making it indispensable in aerospace, medical, and semiconductor industries.

Control Systems:

Open-loop systems: These systems send pre-set commands to actuators without feedback. They are cost-effective and often used in lower-end or educational CNC machines. However, accuracy is limited, with tolerances typically around ±0.05–0.1 mm.

Closed-loop systems: Equipped with encoders and sensors, these systems adjust tool movement in real time. Industrial closed-loop CNC machines can achieve repeatability within ±2–5 microns, ensuring stable performance in demanding environments like aerospace turbine blade machining or surgical implant production.

Automation Levels:

CNC machining spans a wide spectrum of automation:

Entry-level: Manual-load 3-axis milling machines, suitable for prototyping or small-batch runs.

Mid-level: Semi-automated 4- and 5-axis machining centers with pallet changers.

High-level: Fully automated robotic cells capable of continuous, unattended operation, running 24/7 (lights-out manufacturing). These advanced systems can increase equipment utilization rates from 40–50% (manual setups) to over 85–90% with robotics and monitoring software.

CNC Machining Industry Status And Scale

Current Market Scale

By 2026, the global CNC machine tool market is projected to exceed USD 129 billion, with a compound annual growth rate (CAGR) of around 9–10% (2022–2026). This surge is primarily driven by rising demand for electric vehicle (EV) components, the expansion of aerospace manufacturing capacity, and reshoring efforts in North America and Europe, aimed at reducing supply chain vulnerabilities.

Key Growth Drivers

Lightweight Alloys and Composites

The shift toward aluminum 6xxx/7xxx, titanium, and carbon-fiber composites is reshaping machining demand. For instance, aerospace structures now use up to 40–60% composites by weight, requiring high-precision CNC milling and drilling.

Medical Devices

The global medical device market is growing at 5.5% CAGR, with CNC machining indispensable for producing implants, surgical instruments, and diagnostic equipment. CNC precision enables compliance with ISO 13485 and FDA standards.

Industry 4.0 Adoption

Integration of IoT sensors, digital twins, and AI-driven CAM software is increasing productivity by 20–30% in connected machining cells. For example, predictive maintenance reduces machine downtime by up to 25%.

Regional Outlook

Asia-Pacific (APAC):

Dominates production, accounting for over 55% of global CNC machine tool output. China remains the largest market, with Japan, South Korea, and Taiwan leading in high-tech machine tool exports.

Europe:

Focuses on high-value applications such as aerospace and defense. Germany alone contributes nearly 25% of Europe’s CNC exports, specializing in precision engineering and 5-axis solutions.

North America:

Driven by reshoring of automotive and electronics manufacturing. The U.S. invests heavily in EV battery plants and semiconductor fabs, both of which rely on precision machining.

From my project experiences, I see smaller machining companies investing in mid-level automation, such as pallet changers and tool monitoring systems, to remain competitive on cost and lead time. Meanwhile, OEMs and Tier-1 suppliers are moving toward fully connected smart factories, with end-to-end digitalization, real-time quality monitoring, and lights-out manufacturing cells.

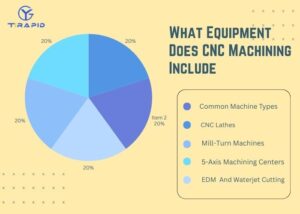

What Equipment Does CNC Machining Include

Different types of CNC equipment, each with its own unique characteristics, range from the versatility of vertical machining centers to the complex surface processing capabilities of five-axis machine tools, to the specialized material processing capabilities of EDM/water jet cutting. Together, these devices constitute the core equipment of modern manufacturing. The future trend is toward multifunctional integration (turn-milling), intelligence (automation, IIoT), and high precision (five-axis, micromachining).

Common Machine Types

Machining Centers

Vertical Machining Centers (VMCs): Spindle is vertically oriented, suitable for flat and prismatic parts.

Accuracy: Positioning accuracy ±0.005 mm, repeatability up to ±0.003 mm.

Applications: Molds, automotive housings, electronic parts.

Market Data: VMCs account for 60%+ of CNC machining centers globally due to lower cost and simpler structure.

Horizontal Machining Centers (HMCs): Spindle is horizontally oriented, ideal for mass production with better automation.

Chip removal efficiency is 20–30% higher than VMCs.

Commonly used in automotive engine blocks and aerospace structural parts.

CNC Lathes

Features: Best for shafts and sleeve-type parts, combining high efficiency with precision.

Accuracy: Roundness error in high-end CNC lathes can be controlled within 0.02–0.05 mm.

Applications: Automotive drive shafts, aerospace fasteners, medical implants.

Market Share: CNC lathes make up 35–40% of the global CNC machine tool market.

Mill-Turn Machines

It integrates turning, milling and drilling in one machine, and can complete multiple operations in one clamping.

Benefits: Reduces re-clamping errors, boosts efficiency by 30–50%.

Applications: Aerospace components, turbine parts, precision medical devices.

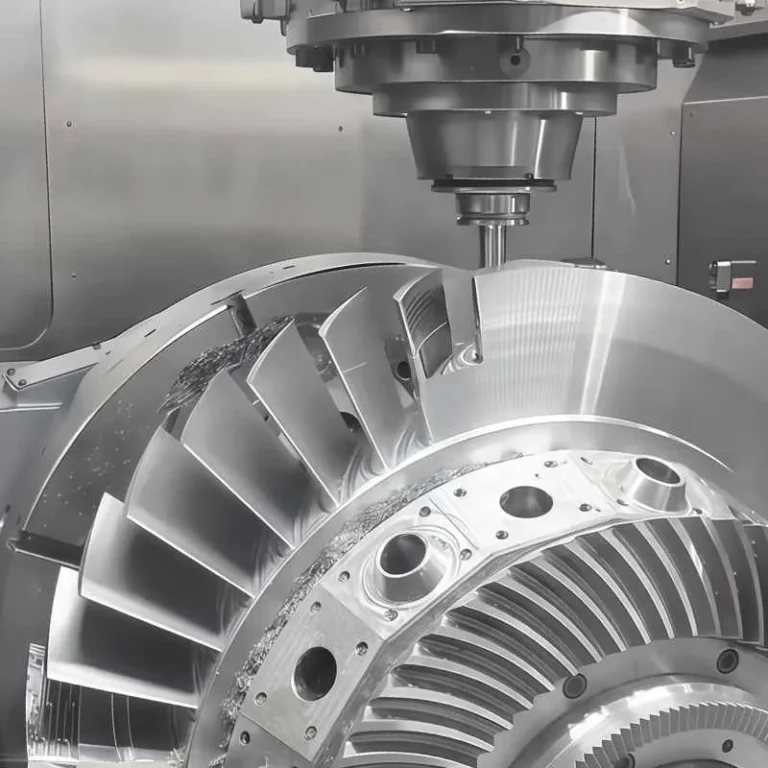

5-Axis Machining Centers

Features: Tool moves along X, Y, Z plus two rotary axes, enabling complex curved-surface machining.

Accuracy: Ultra-precision with errors within ±0.02 mm.

Applications: Turbine blades, automotive molds, medical implants.

Market Data: 5-axis machines have >70% adoption in aerospace industries, critical for lightweight part production.

EDM (Electrical Discharge Machining) And Waterjet Cutting

EDM: Uses electrical discharges to erode conductive materials, suitable for hard steels and molds.

Metrics: Kerf width 0.1–0.3 mm, surface roughness up to Ra 0.2 μm.

Applications: Mold industry accounts for 50%+ of EDM usage.

Waterjet Cutting: Employs ultra-high-pressure water (3000–6000 bar), often with abrasives.

Benefits: No heat-affected zones, works with metals, ceramics, composites.

Accuracy: Cutting precision ±0.1 mm, widely used for aerospace composites.

CNC Plasma Cutting

Process: High-temperature plasma arc melts and removes material.

Suitable For: Medium to thick steel plates, stainless steel, and aluminum.

Accuracy: Cutting precision ±0.2–0.5 mm.

Efficiency: Cutting speed is 5–7× faster than oxy-fuel cutting.

Applications: Shipbuilding, construction steel structures, heavy machinery.

What Are The Process Flows Of CNC Machining

The CNC machining workflow is not a single step but a digitally integrated chain: CAD,CAM , Simulation , Programming , Machining , QMS Inspection. Each stage reinforces precision, efficiency, and consistency, forming the backbone of high-quality manufacturing in aerospace, automotive, medical, and energy sectors.

CAD (Computer-Aided Design)

Purpose: Transforms design concepts into precise 3D digital models.

Key Tools: AutoCAD, SolidWorks, CATIA are widely used for geometry, surfaces, and assembly modeling.

Industry Data: Over 80% of manufacturing firms use CAD as the starting point for CNC machining.

Example: In automotive component projects, CAD models are also used for FEA (Finite Element Analysis) to verify structural performance before machining.

CAM (Computer-Aided Manufacturing)

Purpose: Converts CAD models into machining strategies and toolpaths.

Functions: Toolpath generation, cutting parameter optimization, and tool library management.

Impact: CAM improves programming efficiency by 30–50% and reduces human errors significantly.

Common Platforms: Mastercam, Siemens NX, Autodesk Fusion 360.

Simulation

Purpose: Virtually validates machining operations before cutting begins.

Benefits: Prevents tool collisions, minimizes scrap, and optimizes machining time.

Data Point: Simulation reduces trial-cutting time by 40% and improves tool utilization by 20%+.

Application: In aerospace turbine blade machining, simulation fine-tunes 5-axis toolpaths, lowering rework rates.

Programming (G/M Codes)

Definition: Translates CAM outputs into executable instructions (G-code/M-code) for CNC controllers.

Examples:

G01: Linear interpolation

M06: Tool change

Trends: AI-assisted programming shortens code generation cycles by up to 50%.

Case: In medical implant machining, CAM-generated code ensures tolerances within 0.05 mm.

Machining Execution

Process: Machines perform milling, turning, drilling, and other operations as instructed.

Automation Levels: Ranges from manual 3-axis setups to fully automated 5-axis robotic cells.

Performance: Advanced 5-axis machines achieve ±0.02 mm accuracy, with productivity improvements exceeding 200%.

Example: In aerospace production, robotic loading/unloading combined with 24/7 “lights-out” machining ensures maximum throughput.

Inspection (QMS – Quality Management System)

Purpose: Ensures final parts meet dimensional, geometric, and surface standards.

Methods: CMM (Coordinate Measuring Machines), SPC (Statistical Process Control), Cpk (Process Capability Index).

Data Point: Proper QMS boosts yield rates from 93% to 99.5%, cutting rework costs significantly.

Standards: ISO 9001, AS9100 (aerospace), IATF 16949 (automotive).

Design For Manufacturing (DFM), KPI, And Quality Control

Design for Manufacturing (DFM)

Role: Prevent production issues at the design stage — about 80% of manufacturing costs are determined during design.

Key Measures:

Simplify part geometry to reduce re-clamping and special tooling.

Select materials wisely (e.g., aluminum 6061 has ~40% higher machining efficiency than titanium).

Consider process limits (e.g., depth-to-diameter ratio ≤ 8:1).

Case Example: In automotive parts, applying DFM shortened machining time by 15–20% and reduced scrap rates.

Key Performance Indicators (KPI) in CNC Machining

Overall Equipment Effectiveness (OEE): Measures utilization, world-class factories achieve 85%+.

First Pass Yield (FPY): Ideal > 98%, showing the percentage of parts that pass without rework.

Cycle Time: Directly affects delivery capability, toolpath optimization can reduce it by 10–30%.

Tool Life and Costs: Tooling costs represent 10–15% of total CNC machining costs, monitoring extends tool life and lowers expenses.

On-Time Delivery (OTD): A core KPI in machining shops, with leading companies achieving 95%+.

Quality Control (QC)

SPC (Statistical Process Control): Real-time monitoring with statistics, in aerospace, SPC reduces defect rates by 30–40%.

FAI (First Article Inspection): Confirms design and process correctness before mass production.

Cpk (Process Capability Index): Cpk ≥ 1.33 indicates stable mass production, Cpk ≥ 1.67 is typical for automotive and medical components.

Inspection Tools: Coordinate Measuring Machines (CMM), laser scanners, surface roughness testers.

Example: CMM accuracy can reach ±2 μm, essential for aerospace and medical industries.

How CNC Software And Digitalization Are Changing The Industry

CNC software and digitalization are reshaping manufacturing, boosting efficiency from programming to supply chain. CAM and cloud computing shorten setup, while AI toolpath optimization reduces errors. Digital twins and VR/AR enable virtual training and process validation. IIoT connects machines, with sensors feeding MES/ERP for predictive maintenance and traceability. These advances cut costs and accelerate CNC’s transition toward smart, automated Industry 4.0.

CAM, Cloud, And AI: Smarter Programming And Toolpath Optimization

With modern Computer-Aided Manufacturing (CAM) software, I can rapidly transform CAD files into optimized toolpaths, significantly reducing programming time compared to manual coding. Studies show that CAM adoption can lower toolpath preparation time by 30–50%, while improving machining accuracy by up to 20% through advanced collision detection and adaptive feed strategies.

Cloud platforms extend these capabilities even further:

Secure Storage & Sharing: Programs are stored in encrypted environments with access control, ensuring compliance with ISO 27001-level data security. Multi-site manufacturers report 25–35% faster collaboration when sharing tool libraries and NC programs across global teams.

Remote Simulation: Heavy 3D machining simulations, which can take hours locally, are offloaded to cloud clusters, cutting average simulation time by 40%, while freeing up local workstations for other tasks.

AI-Driven Toolpath Optimization: Artificial intelligence analyzes material properties, cutting conditions, and prior job history to auto-generate toolpaths and machining parameters. This reduces human programming errors by up to 50% and improves first-pass yield rates by 15–20%.

In real-world production environments, these improvements translate into shorter setup times, lower scrap rates, and faster time-to-market.

Digital Twins And Full-Process Simulation

Definition and Role: A digital twin is a virtual replica of a physical CNC machine or production line. It synchronizes with real operations through live data streams and advanced simulation models.

Use Cases:

Tool Wear & Thermal Deformation: For example, in turbine blade machining, thermal deformation can introduce deviations of up to ±10 μm. Digital twins predict and compensate for these distortions.

Workflow Validation: New toolpaths or fixturing setups can be tested virtually before physical trials, cutting average development cycles by 15–25%.

Operator Training: Personnel can practice programming and machine operation in the digital environment, avoiding downtime.

Industry Data: According to McKinsey (2024), manufacturers adopting digital twins report 20–30% productivity gains and 15% lower unplanned downtime.

VR/AR In Training And Debugging

Immersive Training: VR/AR creates realistic multi-axis machine simulations. Training time is reduced by 30–40%, while error rates drop significantly.

Remote Debugging: With AR glasses, engineers can provide real-time support across locations, cutting travel and troubleshooting costs.

Industry Adoption: In automotive and aerospace, AR-assisted assembly of engine components has been shown to halve diagnosis and adjustment times.

Remote Monitoring And IIoT Connectivity

Real-Time Monitoring: Embedded sensors capture spindle vibration (±0.1 g), tool temperature (±1°C), and cutting forces.

Data Integration: These inputs are fed into MES (Manufacturing Execution Systems) and ERP (Enterprise Resource Planning) platforms, enabling:

Predictive Maintenance: Vibration spectrum analysis forecasts tool wear, extending tool life by 20% or more.

Production and Supply Chain Visibility: Plants across continents can share live production data for better scheduling.

Full Traceability: Each step, from raw stock to finished part, is logged—essential for aerospace and medical compliance.

Market Outlook: The global IIoT market in manufacturing is growing at a 12–15% CAGR, with projections exceeding $1 trillion by 2030.

In Which Direction Is CNC Technology Evolving

CNC technology is evolving toward automation, micromachining, and hybrid manufacturing. Robotic loading/unloading boosts spindle utilization by 20%, making lights-out machining feasible even for mid-size shops. Micromachining achieves ±2 μm tolerances, critical for semiconductors and medical implants, using diamond tooling and vibration control. Hybrid manufacturing integrates 3D printing near-net shaping with CNC finishing, cutting material use and cycle times. Though equipment costs are ~30% higher, ROI is strong in aerospace and medical sectors.

Automation And Robotics

Loading and Unloading Automation

Current Adoption: Robotic arms for material handling are increasingly common in CNC workshops, especially in mid- to large-scale factories.

Efficiency Gains: Data shows automated loading/unloading can improve spindle uptime by 15–25%, eliminating idle periods caused by manual handling.

Labor Savings: In a typical three-shift production line, robotic handling reduces the need for 2–3 operators, lowering labor costs significantly.

Case Example: At an automotive parts supplier I worked with, introducing a 6-axis robot cut part loading/unloading time from 45 seconds to 20 seconds, boosting throughput by 30%.

Flexible Production Lines

Definition: Flexible lines combine robotic cells, programmable fixtures, and automated conveyors, allowing rapid product changeovers.

Advantages:

Changeover time reduced by 40–60%.

A single production line can accommodate 3–5 part types without major hardware changes.

Inventory and floor space usage improved by 20%.

Market Data: According to the International Federation of Robotics (IFR, 2023), about 42% of CNC machining companies globally have adopted some level of flexible automation, with strong presence in automotive and consumer electronics sectors.

Lights-Out Manufacturing

Concept: Refers to fully unattended production, where robots manage loading, tool changes, and in-process monitoring.

Feasibility: Once limited to major OEMs, lights-out machining is now attainable for mid-sized manufacturers thanks to IIoT, predictive maintenance, and smarter monitoring systems.

Performance Metrics:

Annual machine utilization can rise by 50–70%.

Aerospace suppliers report lead time reductions of 25–30% with automated overnight runs.

ROI for such investments is typically achieved within 18–24 months.

Challenges: High reliability in sensors and real-time feedback (tool wear, vibration, thermal stability) is essential, or entire batches risk scrap.

Micromachining And Ultra-precision engineering

Micromachining refers to CNC processes that produce parts with dimensions in the millimeter-to-micron scale, often used in semiconductor, aerospace, and medical industries. Ultra-precision engineering pushes tolerances to sub-micron (≤ ±1–2 μm) and surface roughness levels as fine as Ra 0.01–0.05 μm. Compared with conventional machining (±10–20 μm tolerance, Ra 0.8–1.6 μm), this represents an order-of-magnitude leap in accuracy and finish.

| Category | Tolerance Control | Surface Roughness (Ra) | Application Fields | Technical Support |

| Standard CNC | ±10–20 μm | 0.8–1.6 μm | Automotive parts, general machinery, mold making | Standard tools, 3-axis/4-axis machines, conventional processes |

| Micromachining | ≤ ±2 μm (some cases down to ±0.5 μm) | 0.1–0.4 μm | Semiconductor components, precision electronics, medical stents | High-speed milling, temperature-controlled environments, closed-loop control |

| Ultra-Precision Machining | ≤ ±1 μm (nanometer-level positioning) | 0.01–0.05 μm | Aerospace turbine blades, optical lenses, medical implants, MEMS | Diamond tooling, air-bearing spindles, active vibration control, laser metrology |

Hybrid Manufacturing: CNC + Additive Integration

Hybrid manufacturing is emerging as a transformative approach that combines the strengths of additive manufacturing (AM/3D printing) and subtractive CNC machining. Instead of viewing these as competing processes, manufacturers increasingly integrate them into one workflow to maximize efficiency and product performance.

Near-Net Shape Printing

Additive manufacturing is used to build near-net shapes, minimizing material waste.

Studies show that for aerospace titanium parts, near-net printing reduces raw material usage by up to 70%, especially valuable for high-cost alloys like Ti-6Al-4V.

Printing complex internal geometries (e.g., cooling channels in turbine blades) is far easier with AM than CNC alone.

CNC Finishing for Accuracy and Surface Quality

While AM provides shape flexibility, its as-printed surface roughness often exceeds Ra 5–15 μm.

CNC machining complements AM by refining dimensional tolerances to ±2–5 μm and achieving mirror-level finishes (Ra < 0.4 μm).

This dual workflow ensures both design freedom and functional performance.

Cost Savings in Materials and Cycle Time

By depositing material only where needed, additive processes can cut buy-to-fly ratios (raw material vs. final part weight) from 20:1 to 3:1 in aerospace production.

Cycle times are also reduced: printing + machining workflows have demonstrated 30–50% shorter lead times compared to traditional billet machining.

Hybrid methods are especially effective for low-to-medium production volumes, where tooling costs for casting or forging would be prohibitive.

ROI and Industrial Applications

Machine Costs: Hybrid CNC-AM machines can be 20–30% more expensive than traditional 5-axis CNC machines.

ROI Potential: Despite the higher CAPEX, ROI is strong in sectors like:

Aerospace – lightweight structural components, turbine blades, near-net titanium parts.

Medical – custom implants, orthopedic devices, dental prosthetics where patient-specific geometry is critical.

Market forecasts project the global hybrid manufacturing market to grow at a CAGR > 18% between 2024–2030, reaching USD 4–5 billion by 2030.

What Material Innovations Are Emerging In CNC Machining

Metal alloys remain the cornerstone of CNC machining, yet composites and nickel-based alloys are pushing the boundaries of performance. At the same time, ceramics and non-metals are creating new opportunities in electronics and medical applications. Although sustainable materials still face limitations in machinability, they undoubtedly represent the future of green manufacturing and environmentally responsible production.

| Category | Material Examples | Key Properties | Challenges / Considerations |

| New Alloys & Composites | Aluminum 6061/7075 | High strength-to-weight ratio, excellent machinability, corrosion resistance | 7075 has lower corrosion resistance, relatively higher cost |

| Titanium Alloys (e.g., Ti-6Al-4V) | Superior strength-to-weight, biocompatibility, corrosion resistance | Difficult to machine, high tool wear | |

| Nickel-Based Alloys (Inconel, Hastelloy) | High-temperature strength (700–1000°C), fatigue resistance, corrosion resistance | Poor machinability, requires carbide/ceramic tools | |

| Carbon Fiber Composites | Ultra-lightweight, very high tensile strength | Prone to delamination, requires diamond tooling | |

| Ceramics & Non-Metals | Engineering Plastics (PEEK, Delrin/POM) | High mechanical strength, chemical resistance, machinability | Heat-sensitive, limited load capacity |

| Graphite | Excellent electrical conductivity, high-temperature resistance | Brittle, prone to edge chipping during machining | |

| Biodegradable & Sustainable Materials | Biodegradable Polymers (PLA, PHA) | Eco-friendly, lightweight, biodegradable | Poor machinability, low heat resistance |

| Recycled Metal Alloys | Cost reduction, energy-efficient, environmentally sustainable | Mechanical properties less consistent |

What Market Trends And Drivers Are Shaping The Industry

The CNC machining industry is evolving under three forces: rapid market growth in EVs and aerospace, supply chain reconfiguration through reshoring and localization, and sustainability-driven investments in energy-efficient, low-waste production. Together, these factors are reshaping global competition and pushing the industry toward smarter, greener, and more resilient manufacturing models.

Market Growth, Regional And Industry Shifts

The global CNC machining market is projected to reach $128–129 billion by 2026, growing at a CAGR of around 5–6%. Asia-Pacific remains the manufacturing hub, accounting for over 50% of global machine tool production, largely driven by China, Japan, and South Korea. North America and Europe dominate high-value applications such as aerospace, defense, and medical devices, with Germany and the U.S. leading in precision engineering and high-end automation adoption. Industry structure is shifting toward EVs, renewable energy equipment, and semiconductors, all of which demand tighter tolerances and advanced materials.

Resourcing And Global Procurement

Global supply chains are undergoing restructuring. Rising logistics costs and geopolitical risks have pushed companies toward reshoring and localized supply chains. For example, surveys in 2024 showed that 38% of U.S. manufacturers had already shifted part of their production back from Asia to North America. This trend reduces dependency on single regions, shortens lead times, and improves resilience against disruptions. Localized procurement strategies are increasingly focused on raw material availability (aluminum, titanium, composites) and strategic partnerships with regional toolmakers and software providers.

Sustainability And Green Manufacturing

Sustainability is now a central driver. CNC machining companies are investing in energy-efficient machine tools, with modern spindles consuming 15–20% less energy than older models. Recycling of machining chips and coolants can reduce waste by up to 30%, while advanced toolpath optimization (using AI-driven CAM) can lower cycle times by 10–15%, cutting both cost and CO₂ emissions. Regulations such as EU Green Deal and U.S. Inflation Reduction Act incentivize greener practices, pushing manufacturers toward circular economy models and life-cycle analysis of parts. The focus is no longer just cost per part, but carbon footprint per part.

What Challenges And Risks Does The CNC Industry Face

The CNC industry’s risks center on ROI challenges, labor shortages, cyber threats, and supply chain compliance. Addressing these head-on is critical for companies that want to succeed in the next era of intelligent, automated, and sustainable manufacturing.

Complexity Management And Cost Control (TCO, ROI)

High Capital Investment: A high-end 5-axis CNC machining center typically costs $300,000–$500,000, and with robotic loading/unloading systems, the total investment can reach $800,000–$1 million.

ROI Pressure: For SMEs, ROI payback cycles are often 3–5 years, while large OEMs can shorten this to 18–24 months through economies of scale.

Complexity in Operations: As parts become more complex, multi-tasking machines (e.g., mill-turn centers) reduce setups but increase programming and tooling complexity. This can raise production planning and scheduling costs by 15–20%.

Skills Shortage And Talent Development

Aging Workforce: In the U.S., over 25% of CNC machinists are aged 55+, indicating a looming retirement wave.

Talent Gap: According to NIMS (National Institute for Metalworking Skills), the annual shortfall in CNC technicians is 60,000–80,000 workers.

Mitigation Strategies:

Apprenticeship Programs: Dual-education models in Germany and Japan have proven effective in closing skill gaps.

Cross-Training: Expanding operator skills to cover CAD/CAM, CNC programming, and quality inspection helps achieve “multi-skilled” teams.

Cybersecurity And Data Governance

Increased Exposure: With IIoT and Industry 4.0 adoption, CNC machines are connected to MES/ERP systems, expanding attack surfaces.

Rising Threats: In 2023, manufacturing became the #1 target of ransomware attacks (25% of all cases).

Best Practices:

Implement end-to-end encryption and multi-factor authentication.

Conduct regular cybersecurity training for operators.

Use access control and audit logs for sensitive CAD/CAM data.

Supply Chain Resilience And Compliance

Global Volatility: Pandemics and geopolitical events have caused raw material volatility, titanium and nickel alloys saw price swings of 40–60% in recent years.

Reshoring Trends: In 2024, 38% of North American manufacturers reported reshoring or nearshoring operations to reduce tariff risks and shipping delays.

Compliance Burden:

Aerospace and automotive supply chains require strict adherence to ISO 9001, IATF 16949, and AS9100.

Third-party audits are now standard practice among global OEMs.

Non-compliant suppliers risk exclusion from strategic supply chains.

What Are The Typical Applications Of CNC Machining

CNC machining spans aerospace, automotive, medical, electronics, and energy industries, ensuring high precision and repeatability. It produces critical parts like airfoils, engine blocks, implants, phone housings, and propellers, making it a cornerstone of modern manufacturing.

| Industry | Key Applications | Technical Notes |

| Aerospace and Defense | Airfoils, landing gear, manifolds | Ultra-high tolerances up to ±0.00004″ (≈1 μm), safety-critical components where reliability is non-negotiable |

| Automotive and Transportation | Engine blocks, EV battery housings, prototypes | CNC ensures strength, repeatability, and speed, widely used for prototype validation of new vehicle models |

| Medical Devices and Implants | Surgical instruments, implants, MRI housings | Biocompatible and sterilizable materials, tolerances critical for implants and precision surgical tools |

| Consumer Electronics & Semiconductor Equipment | Smartphone housings, connectors, precision frames, semiconductor tools | Requires micromachining, features as small as tens of microns, critical for miniaturization |

| Energy, Marine & Industrial Machinery | Valves, drill bits, propellers | CNC machining guarantees performance under extreme pressure, corrosion, and high-wear environments |

FAQs

How Big Is The CNC Industry?

I follow the CNC industry closely, and by 2026, its global market is projected to reach $128–129 billion. Growth is driven by aerospace, EVs, and medical devices, with Asia-Pacific leading production and North America/Europe focusing on high-tech demand.

Does CNC Have A Future?

Yes, absolutely. I see CNC evolving with automation, robotics, and AI integration. Micromachining now achieves ±2 μm tolerances, critical for semiconductors and implants. With Industry 4.0, CNC will remain the backbone of precision manufacturing.

What Industries Benefit Most From CNC Machining?

From my projects, the biggest users are aerospace (70%+ 5-axis adoption), automotive (engine blocks, EV parts), and medical (implants, surgical tools). Electronics and energy also rely heavily on CNC for precision components under extreme conditions.

How To Choose The Best CNC Manufacturer?

I always check ISO9001/IATF certifications, machine capacity (3–5 axis, EDM, Swiss), and delivery speed. Strong suppliers process 10,000+ parts/month, offer design-for-manufacturing (DFM), and provide full traceability through MES/ERP systems.

Why Are CNC Machinists So Difficult To Find?

I’ve seen a shortage because the workforce is aging, over 40% of machinists are 45+. CNC demands both digital and hands-on skills, and training new talent takes years. Automation helps, but skilled machinists remain irreplaceable.

Conclusion

The CNC machining industry is at a crossroads of tradition and innovation. It continues to power aerospace, automotive, medical, and electronics with unmatched precision and adaptability. With digitalization, automation, and sustainable practices, CNC machining is not only surviving but thriving in Industry 4.0.Welcom to connect with us to continue the discussion. Your insights could inspire the next wave of CNC innovation.